Annual Review 2017

enoc.com

Accountability to key stakeholders is central to ENOC’s corporate governance philosophy, along with policies and management systems that contribute to efficient and effective operations. Continuous governance improvements are integral to the way ENOC conducts business – reinforcing the role of effective governance as an essential driver of value.

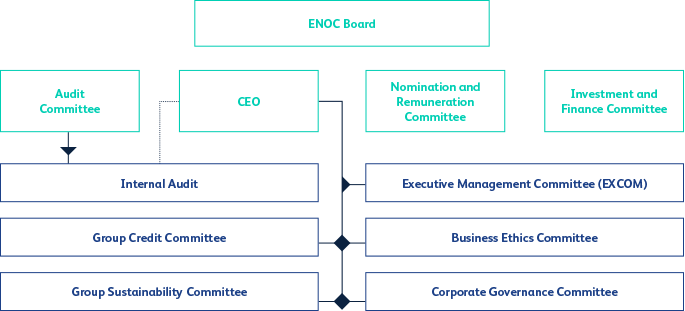

Board of Directors

The Board is responsible for preserving and enhancing ENOC’s long-term value for stakeholders. The Board relies on the integrity and diligence of its senior management team, external advisors and auditors to oversee ENOC’s overall performance objectives, organisational initiatives, annual budgets and financial plans, investments, financial performance reviews, risk management practices, and corporate governance initiatives.

Board Committees

Audit Committee

The Audit Committee assists the Board in fulfilling its responsibilities to oversee the financial reporting process, the internal control system, the audit process, and the organisation’s process for monitoring compliance with laws, regulations and ethics programmes. Along with management and the external auditors, the committee reviews the Group’s financial statements upon completion of the annual accounts, and monitors the integrity and appropriateness of the financial statements. It also oversees the adequacy of internal control systems, reviews the effectiveness of internal audit, and guides the selection, compensation, independence and performance of external auditors.

The Audit Committee is chaired by Hussain Hassan Mirza Al Sayegh. Other members include Ahmad Sharaf and Dr Abdulrahman Al Awar.

Investment and Finance Committee

The Investment and Finance Committee is responsible for the overall review of all investments and certain significant financial matters. It ensures relevance of capital acquisitions, divestments, dilutions of equity and buy-outs to strategic plan. The committee also ensures that all investments, joint ventures, mergers and acquisitions are properly reviewed and studied. It reviews all significant financial issues that warrant Board approval and affect the Group. The committee specifically refers to the Board all budgets, plans, major funding facilities, tax framework and related issues. It oversees internal controls and procedures for the Group’s procurement by reviewing and approving waiver of any competitive bidding due to single sourcing or special corporate requirements.

The Investment and Finance Committee is chaired by Ahmad Sharaf and its director members are H.E. Abdulrahman Al Saleh, Dr Abdulrahman Al Awar, and Ahmad Al Muhairbi. Other permanent members are the Group Chief Executive Officer, Chief Financial Officer, and the relevant segment Managing Director.

Nomination and Remuneration Committee

The Nomination and Remuneration Committee assists the Board to fulfil its oversight responsibilities, primarily the nomination of members to the Board committees; the nomination, remuneration, succession planning, as well as development and performance evaluation; and, if appropriate, the dismissal of the Group’s Executive Committee members. The committee also supports the Board in the same processes with respect to the Group’s representatives on the boards of ENOC’s subsidiaries and joint venture companies.

The Nomination and Remuneration Committee is chaired by Dr Abdulrahman Al Awar, and Ahmad Al Muhairbi is a member.

Group Chief Executive Officer

The Group CEO is responsible for setting the overall tone of the business and directing its growth by developing high-level strategies. His responsibilities include making major corporate decisions, managing the Group’s operations and resources, and acting as the main point of communication between the Board and the corporate functions.

Group CEO Committees

Several Executive Management committees have been established to assist the Group CEO. These are:

Executive Management Committee

The Executive Management Committee (EXCOM) is the Group’s main executive platform that oversees business challenges and strategies, and implements potential synergies between the operational segments. The EXCOM steers matters such as risk management, IT planning and control, EHSSQ compliance, and HR development and performance, which enable it to take a consolidated approach to critical areas of the Group’s operations.

The EXCOM is a recommendatory body headed by the Group CEO. Its proposals are conveyed to the Board through the Group CEO. It includes the Managing Directors of all business segments, the Chief Financial Officer, the Executive Directors of EHSSQ and Corporate Affairs, and the Executive Director of Shared Services.

Group Credit Committee

The Group Credit Committee oversees, reviews, and directs the management of credit risk across the Group.

The Group Credit Committee is headed by the Chief Financial Officer. Its members include the Executive Director of EHSSQ and Corporate Affairs, and the Executive Director of Shared Services.

Business Ethics Committee

The Business Ethics Committee is responsible for maintaining an ethical business environment by providing supervision and assurance on the overall robustness of the Group’s business ethics and fraud management framework.

The Business Ethics Committee is chaired by the Group CEO, and includes the Group Chief Financial Officer, the Director of Internal Audit and Business Ethics, the Group Human Resources Director, and the Group Legal Director.

Corporate Governance Committee

The Corporate Governance Committee’s role is to develop, adopt and implement corporate governance best practice within the Group, in line with legal and regulatory requirements. The committee also ensures that a fully compliant corporate governance programme is in place, while supporting the effective achievement of business goals and objectives.

The Corporate Governance Committee is headed by the Group CEO. Members include the Chief Financial Officer, the Executive Director of EHSSQ and Corporate Affairs, the Director of Internal Audit, and the Group Legal Director.

Group Sustainability Committee

The Group Sustainability Committee provides guidance on developing, implementing and monitoring economic, social and environmental policies, practices and strategies that will foster the sustainable growth of ENOC Group’s domestic and international business.

The Group Sustainability Committee is chaired by the Group CEO, and includes all members of the EXCOM.

External Auditors

Reporting to the shareholders, KPMG, the Group’s external auditors, perform their professional and statutory duties while maintaining full independence.

Internal Audit and Business Ethics

The Internal Audit and Business Ethics (IA&BE) Department is established by the Audit Committee and its authority and responsibility are defined by the Internal Audit and Business Ethics Charters. The IA&BE independently and objectively conducts audits in line with internal audit and business ethics plans that are approved by the Audit Committee (for wholly-owned ENOC Group entities and departments), as well as by the boards and audit committees of other non-wholly-owned ENOC Group entities.

The IA&BE Department reports audit plan progress and the status of audit issues to the audit committees and boards.

Internal Controls

ENOC Group regards effective internal controls as central to its operations and has established systems in line with best practice. These internal controls are continuously monitored and refined (as required) – matching the fast pace of change in the organisation’s contemporary business environment. The Group has determined a number of internal control activities in line with the nature of our businesses’ operations, and has assigned responsibilities in such a way that mutual supervision is in effect.